Coursera Plus - Get Unlimited Access to 7,000+ Online Courses

Coursera Plus - Get Unlimited Access to 7,000+ Online Courses

Coursera Plus - Get Unlimited Access to 7,000+ Online Courses

Is FMVA Worth it? CFI FMVA Certification Review

Disclaimer: This post is NOT sponsored. Some product links are affiliate links which means if you buy through those links, you won’t pay anything extra and we’ll also receive a small commission on a purchase.

If you are in the finance industry or looking to start a career in finance, then you must have definitely heard about FMVA certification offered by CFI, which has been gaining significant traction in recent times.

But is investing your time and money in FMVA certification truly worth it? Let’s delve deeper into that.

In this detailed FMVA certification review, we’ll discuss its importance, pros and cons, career prospects, its real-world value, and much more.

By the end of this review, I hope you will be able to make a clear and informed decision regarding FMVA certification.

You’re in the right place to figure your way out.

Without further ado, let’s get started.

Table of Contents

What is FMVA Certification?

Before analyzing whether the FMVA certification is the best fit for you, let’s first understand its crux in simple terms.

FMVA, also known as Financial Modeling and Valuation Analyst certification, is a comprehensive program designed to equip individuals with advanced financial modeling and valuation skills.

It covers a wide range of topics, including financial analysis, excel skills, modeling, budgeting, forecasting, valuation techniques, and more.

This certification aids in making smart financial decisions when it comes to accurate asset valuation and detailed financial models.

So where is it needed? you may ask.

To maximize the value of assets in the near future, every company needs professionals who can assess and analyze the asset value from day one.

Essentially, if a job requires understanding numbers and making smart financial choices, the FMVA certification can help you stand out.

In that sense, FMVA certification will always be in demand, and it will never go out of style.

Is the FMVA Certification Recognized?

Before answering this question, let me explain briefly where it is valued.

The FMVA certification is particularly valued in fields such as investment banking, private equity, equity research, financial planning & analysis (FP&A), corporate development, and other areas of corporate finance.

Due to this fact, it has gained popularity among finance managers and bankers.

The core reason for this immense demand and popularity is its curriculum.

It is super comprehensive.

They cover everything from financial modeling to valuation to Excel skills.

Moreover, it is offered by CFI – One of the most trusted and leading finance training provider.

They have gained a solid reputation over the years backed by tons of positive reviews and their unique practical learning approach.

In 2021, CFI reached the milestone of 1 million students with a valuation exceeding $100 million.

They have been trusted by finance and banking professionals worldwide including Amazon, BlackRock, University of Toronto, Deutsche Bank, etc.

Based on all the facts and taking 1 million students trained into consideration, FMVA certification has earned its place as a valuable credential for professionals looking to advance their careers in finance.

So, without a doubt, the answer is a big YES! FMVA certification is highly recognized.

Is CFI FMVA Certification Worth it?

Let’s put a simple math here.

The worthiness of any certification depends on the quality of the lessons it offers. Right?

Ok, What determines the quality of the lessons?

Expert instructors.

And the quality of the instructors is determined by the recognized and renowned educational platform they are working in.

Correct?

Now, when you fit FMVA certification into this, it will easily check all the boxes and top the chart.

Let’s start with its bite-sized lessons.

Their bite-sized quality lessons make it easier for even individuals with non-financial backgrounds, like me, to grasp concepts from the ground level.

It is not typically the case with most certifications we encounter daily. Isn’t it? You enroll in a course. The huge volume and duration of each chapter overwhelm you, causing you to lose your grounding.

But that’s not the case with FMVA.

They have this clear and well-structured lesson plan that helps you in focused study.

Each chapter contains a mini-model that gradually evolves into a full-fledged model.

For example, if you take Excel Fundamentals prep course, they break down each chapter into small chunks, making it easy to digest the material without feeling overwhelmed.

Under the Excel Layout section, you’ll find subsections like Layout Overview, Creating Formulas, Keyboard Shortcuts, etc.

This structured approach enables learners to thoroughly grasp each concept and retain the information more effectively.

So, when you reach the end of the chapter, you’ll feel confident in recalling what you’ve learned.

This strengthens your foundation. And keeps you on track.

If you feel like you’re losing your grip, you can go back and bridge the gap.

Next comes the instructors.

At CFI, you can get to know your instructors and their credibility before entering into the course.

The instructors are Tim Vipond, Scott Powell, Duncan McKeen, and Jeff Schmidt.

They’ve got tons of experience in finance industry.

Especially Scott Powell, with over 30 years, is a real standout for me.

Regarding online learning experience, they don’t seem to be reading off a script. Their teaching emphasizes that they know what they’re teaching, making it more authentic.

The experts at CFI managed these lengthy sessions with so much intent, ensuring the lessons remained engaging and seamlessly flowing.

Their ability to captivate students makes it easy to lose track of time, as you become fully immersed in the learning experience.

That said, no online course can match a traditional classroom setting.

But their expertise makes it worthy.

Here comes the best part!!

The one thing I will rave about CFI FMVA certification is its practicality.

Unlike other courses with boring theoretical lectures, FMVA certification is geared toward real-world applications.

This sole reason leads many students to opt for this certification because it teaches not only ‘what’ but also ‘how’ and ‘where’ to use the knowledge.

Right then and there.

At the end of each chapter, you get to execute what you’ve learned, and the added advantage is that you can practice numerous times until you feel ready to move on.

For instance, When learning about AI-enhanced financial analysis, each chapter concludes with hands-on experience, enabling you to directly implement what you’ve learned in interactive exercises.

There’s nothing quite like rolling up your sleeves and applying the techniques demonstrated by the experts.

When you witness the same results they achieve, trust me, it’s incredibly rewarding and motivating.

This practical knowledge factor simplifies the hiring process for companies and positions candidates for higher-paying roles in finance.

When it comes to hiring based on theoretical or practical knowledge, obviously, you’ll choose the practical one, right?

That’s where FMVA stands out.

The lessons are more about learning and executing rather than learning and forgetting.

In addition to the technical aspects, what appeals more to me about the FMVA certification is its focus on the intricacies required to excel in the finance industry. If mastering these nuances is your goal, taking up this FMVA certification could be an excellent choice for you.

But let’s not sugarcoat it. No course is 100% perfect.

Some folks have pointed out that while CFI’s FMVA program content is top-notch, those already in the finance industry may find it limiting as they don’t learn much new.

One size does not fit all.

Also, if your sole aim is to complete the certification, then it’s fine, and you can complete it in time.

However, you may find it challenging to complete the certification in less than six months while juggling a job or studying for other courses as the final exams are even more challenging and require serious effort.

Again, if you are committed to the hustle, then it shouldn’t bother you much.

So now let’s get back to where it all started. Is the CFI FMVA certification worth it? Definitely YES. Bite-sized quality lessons, top-notch instructors, and its renowned practicality speak for themselves.

Here is a sample CFI FMVA certificate. If you complete the FMVA certification program successfully, you’ll receive a certificate like this from Corporate Finance Institute (CFI) with your name on it.

Pros and Cons

CFI FMVA Syllabus: What You’ll Learn?

The FMVA program offers 57 courses comprising 3260+ lessons, including 200+ interactive exercises.

The course is 100% online and so flexible that you can take it at your own pace and access it worldwide.

It takes at least 3 to 6 months to complete, and depending on your schedule, it may change.

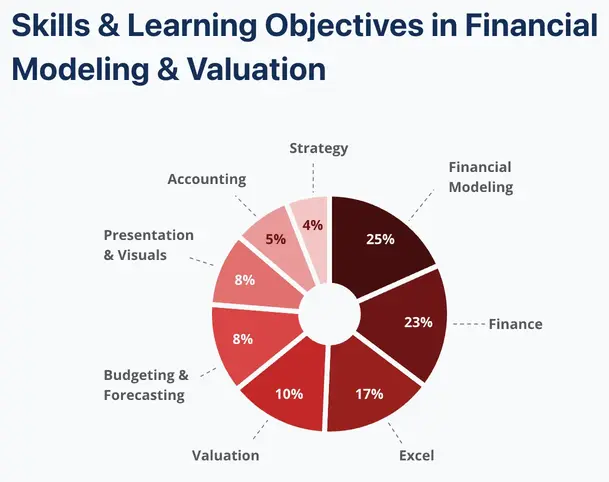

65% of the course primarily focuses on financial modeling, finance, and excel.

- You’ll learn in detail on how to make a plan for future income, organize financial information, manage cash, and understand how changes can affect finances.

- You’ll also learn Advanced level formulas, quick ways to use your keyboard, and how to look at data to make your money plans in Excel.

- Plus, you’ll figure out how to tell if a business is doing well by looking at its profits, how efficient it is, and other important factors using financial tools and ratios.

The remaining 35% covers accounting, strategy, presentation & visuals, budgeting & forecasting, and valuation.

- Certification starts with 9 optional prep courses, which we recommend taking if you are new and looking to strengthen your fundamentals.

Under each course, they provide a clear overview and learning objective, making the process smooth and clear.

- Moving on to the core courses. You must complete 14 courses to advance to the electives.

Even if you skipped the optional prep course, they will recommend some prerequisite courses to ensure the comprehensive understanding that is needed for the selected course.

For example, if you are taking the Introduction to 3-statement Modeling course, they will recommend taking the prep courses of accounting fundamentals and Excel fundamentals to understand and execute the course better.

- Once done, you will get into electives – Advanced level.

You have the option to select at least 3 courses from the 27 available.

However, you are not limited to just 3. You can select even more depending on your interests.

My personal favorite is ESG integration and financial analysis. It was led by Kyle Peterdy and Rahul Gill. I thoroughly enjoyed the class

- The syllabus also includes Case studies, where you will be dealing with real-world problems and solutions. Even though it is optional, many students opt for these to apply their skills to current scenarios.

They offer 2 case study challenges.

One is renewable energy – solar financial modeling.

The other one is the Amazon case study, which is quite popular.

The course is based on a case study of Amazon, and students are tasked with building a financial model and performing comparable company analysis to value Amazon shares and make investment recommendations.

Pro Tip: Don’t miss the Amazon case study in electives. It was fun and full of insights.

You will be having a course assessment for each course for which you have to score 80% to qualify for your final exams.

CFI FMVA Final Exam: Is it really hard?

Everything comes down to this one question. Right?

“How hard is the final exam?”

Let me explain.

You must score 70% on the final exam to earn your program certification and become FMVA certified.

You can also take practice exams before the final exam which is completely optional.

The final exams are moderately challenging compared to the assessment tests and practice exams.

The duration of the FMVA final exam is 3 hrs. It consists of 50 multiple-choice questions, including Excel modeling case studies.

However, the advantage is that you can retake the exam as many times as you need until you pass.

But there is a 30-day waiting period between each retake attempt.

So, yes, the final exams are relatively challenging. You can’t rely on the same set of questions you cracked in the assessment exams.

But it’s not the kind of tough that keeps you up at night or takes years to complete.

If you don’t pass on your first attempt, don’t worry. It might take one or more tries, but with dedication, you can definitely crack it.

Pro tip: Retake your practice exam several times. Each time, you’ll get new questions that will help you understand what questions to expect in your final exams.

Career Opportunities after FMVA Certification

The FMVA certification is a popular choice for those seeking to upskill their financial modeling and valuation skills and advance their careers in finance.

With the certification, you will be the best fit for a financial analyst role.

Financial analysts analyze financial data to assist businesses and individuals in making informed investment decisions.

Having the certification will give you an upper hand compared to others competing for the same role.

The average income of financial analysts ranges between $80,000 to $125,000 per year.

In investment banking, you will be responsible for determining company values and managing significant financial transactions such as mergers.

In private equity, FMVA skills are highly valuable. You will be making critical decisions regarding investment opportunities, ensuring their viability, and assisting companies in developing solid financial plans.

In equity research, you can aid companies by conducting thorough market research and helping them decide where to allocate their funds. With practical skills acquired through FMVA training, you can make accurate predictions.

FMVA-trained professionals excel at determining the value of businesses or their components. They can work in valuation firms, accounting, or company finance departments.

FMVA certification not only boosts your credentials on resumes but also helps individuals secure promotions or positions of greater responsibility with higher pay.

Based on your interests and preferred role, you can choose your career path accordingly.

CFI FMVA Pricing Details

To access the certification, you need to have an active CFI subscription.

CFI offers two membership plans.

Self-Study Membership:

This plan is suitable for those who are comfortable learning on their own.

- Price: Originally $497.00, discounted to $298.20 per year.

- Access: Over 5,000 lessons and 200+ courses.

- Certifications & Specializations: Unlimited access to all CFI certifications and specialization programs.

- Community: Members-only online community.

- Resources: Ready-to-use financial models and templates.

Full-Immersion Membership:

This plan comes with premium features and expert guidance every step of the way.

If you’re looking for that extra motivation and support from instructors to keep you on track, this is the perfect fit for you.

Price: Originally $847.00, discounted to $508.20 per year.

Features: Everything in Self-Study, plus:

- Course-integrated AI-chatbot.

- 1-on-1 guidance

- Financial model review.

- Exclusive partner offers.

In 2024, they introduced a single program subscription where you can choose any one CFI certification, which is currently unavailable. This option may be available only during certain period of a year.

It’s important to note that subscriptions are available on an annual basis only.

Plus, here’s a little bonus for you: Use the coupon code WELCOME10 to enjoy a 10% discount on both the self-study and Full Immersion subscriptions.

CFI FMVA Financial Aid

If financial constraints are holding you back from taking the FMVA certification, you can try applying for CFI’s financial aid.

The aid is allocated based on assessed financial need, the number of applications received, and available funding.

As a first step, you have to enroll in a minimum of six free Prep Courses under the FMVA certification.

When filling out the application form, make sure you have not enrolled in any paid program. Any false statements may result in the cancellation of your financial aid.

Within 2-3 weeks, you will receive an email notification to your registered mail regarding your financial aid decision.

If your application is approved, you will be offered a heavily discounted rate for the self-study subscription plan.

If denied, you’ll receive an email explaining the reasons.

If you missed applying for financial aid for a certain period in the past, you can’t go back and get money for that period. You can only get financial aid for the time after you apply.

Submitting more than one application to hurry up the process is strictly not allowed.

Financial aid will be open only from time to time. Check here for regular updates.

Alternatives

If you’re considering alternatives to the FMVA certification, there are several other reputable finance certifications out there.

For example, the Chartered Financial Analyst (CFA) certification is highly regarded, especially if you’re interested in investment analysis and portfolio management.

CFA Vs FMVA

When considering whether to pursue the CFA or the FMVA certification, keep this key difference in mind.

The CFA certification is widely known for its rigorous curriculum that covers a broad range of topics in finance.

It requires passing three levels of exams and has a strong emphasis on ethical and professional standards.

The CFA program is quite extensive, requiring an estimated 300 hours of study per level, and typically takes several years to complete.

On the other hand, the FMVA certification, as discussed earlier, focuses on practical skills in financial modeling and valuation.

The FMVA program can be completed in less time than the CFA, with a single comprehensive exam at the end of the course.

If you’re aiming for a career in corporate finance, then FMVA might be more beneficial due to its focus on practical financial modeling skills.

If you’re looking to establish yourself in the investment management industry, the CFA might be a good fit for you.

Other FMVA Alternatives

The Certified Public Accountant (CPA) is another well-reputed designation if you lean towards accounting.

Other alternatives include the Chartered Alternative Investment Analyst (CAIA), Certified Financial Planner (CFP), and Financial Risk Manager (FRM) certifications.

Each of these certifications has its own focus, cost, and career benefits, so it’s important to consider which one aligns best with your career goals and interests.

It’s also worth exploring online platforms like Coursera, Udemy, and LinkedIn Learning for finance-related courses that might offer more flexibility or specialization in certain areas.

At the end of the day, it all depends on your career aspirations, learning style, and the specific skills you want to develop.

What others say about CFI FMVA Certification

- “Exceeded Expectations” – Rahul C, Business analyst

- “Transition Into Finance and Business World With The Best Training” – Sharry karisa M, Entrepreneur.

- “Real life examples makes the studies even more interactive” – Ebai D, Data analyst.

- “Wonderful Learning Experience” – Mahip K, Accounting reporting & Controlling analyst

- “The gateway to being a great financial guru” – Geaner C, Assistant store manager.

These are some reviews of CFI FMVA certification.

You can check more reviews here.

On the upside, many people praise CFA FMVA Certification for its practical lessons, well-structured lesson plans, and flexible learning approach.

On the downside, some people stated that the price is a bit steep to afford.

CFI FMVA Certification Review: Final Verdict

In my opinion, taking an FMVA certification under CFI is worth the money, both in terms of quality and learning.

Flexibility is a plus factor for me, and the expert teaching and practical applications significantly boosted my confidence.

But does having this certification guarantee a job?

NO. Let’s be honest here.

It solely depends on the effort and time you are willing to put in every day.

If you are truly passionate and constantly pushing yourself to apply for the right job, you will definitely succeed.

The result you achieve will be the outcome of both certification and your efforts, not just the certification itself.

The FMVA program is designed to impart practical skills in financial modeling and valuation. This means you learn to construct and interpret financial models, which is a crucial skill in the finance sector.

It’s no surprise why the demand for the FMVA is increasing day by day.

However, taking the course solely because it may be relevant in the long run may not be beneficial.

If your objective is clear, and you believe that the financial analysis sector is your ultimate go-to and this is where you are willing to thrive, then FMVA might be the right fit for you.

Just make sure it fits your schedule, budget, and, most importantly, your time. It’s all about commitment.

Rest assured, you will be in safe, expert hands. You can take my word on that.

But if you are in the initial figuring out phase and experimenting to see if financial analysis may be a good option, then with all honesty, I’ll recommend you to invest in the free resources available out there.

It might help you figure it out.

I hope this detailed CFI FMVA review will help you make a clear and informed decision regarding FMVA certification.

Happy learning!

FAQ’s about CFI FMVA Certification

How long does it take to complete FMVA certification?

It takes at least 3 to 6 months to complete, and depending on your schedule, it may change.

How hard is the FMVA final exam?

The final exams are moderately challenging. You must score 70% on the final exam to earn your program certification to become FMVA certified.

FMVA VS CFA. Which is best?

FMVA certification might be more beneficial if you are aiming for a career in corporate finance. If you’re looking to establish yourself in the investment management industry, the CFA might be a good fit for you.

Does FMVA help toward CFA?

Well, FMVA doesn’t directly contribute to CFA but the skills acquired can complement the knowledge required for the CFA program.